[ad_1]

There is perhaps affiliate hyperlinks on this web page, which suggests we get a small fee of something you purchase. As an Amazon Affiliate we earn from qualifying purchases. Please do your personal analysis earlier than making any on-line buy.

Books on budgeting all appear the identical. For essentially the most half, these books cowl the budgeting fundamentals and past…

These books talk about the fundamentals of finance:

All of that is actually essential stuff. little question about that.

However individuals who battle to simply get by each single week might discover it tough to make the cash they’ve coming in meet their price range necessities.

That’s the place these books on saving cash and budgeting come into play.

The purpose of the books on this listing is to present PRACTICAL ADVICE on saving cash.

Each one in every of these books is not going to provide the usual recommendation on the right way to make the price range. These cash saving and budgeting books will present you the right way to make your restricted money movement stretch to achieve your price range wants.

These are as a lot books on frugal dwelling as they’re private budgeting and debt aid books. They talk about specifics on “how to save cash” not simply provide you with platitudes on spending much less cash however to present actionable recommendation on the right way to get by on a shoestring price range and nonetheless pay down any debt.

That’s what makes this assortment of books on saving cash a bit distinctive, and really sensible.

Even in case you have already learn a few of the greatest introductory finance books obtainable, these books nonetheless have quite a bit to show you. If not in regards to the science of budgeting and saving not less than in regards to the artwork of creating your revenue meet your budgetary wants.

If you wish to discover ways to price range, debt proof dwelling, investing and the 7 cash guidelines for all times learn the whole cash makeover by Dave Ramsey. However if you wish to make your greenback stretch additional, then learn any of those books on frugal dwelling, budgeting, saving cash and climbing out of debt.

1. The Easy Greenback by Trent A. Hamm

Takeaways:

- The Easy Greenback provides sensible recommendation on private finance, offering methods for budgeting, saving, and attaining monetary freedom by easy and sustainable practices.

- Trent A. Hamm emphasizes the significance of conscious spending and long-term monetary planning, advocating for a balanced strategy to managing cash and assets.

- The e book offers insights into frugality and the worth of dwelling inside one’s means, providing actionable ideas for lowering bills and making knowledgeable monetary selections.

- The Easy Greenback encourages readers to prioritize monetary well-being and undertake a mindset of economic duty, selling the pursuit of a extra intentional and fulfilling relationship with cash.

- Hamm’s work serves as a helpful useful resource for people in search of to enhance their monetary literacy and obtain better monetary stability, providing sensible steering on managing cash and constructing a safe monetary future.

Trent Hamm makes use of The Easy Greenback: How One Man Wiped Out His Money owed and Achieved the Lifetime of His Desires as a platform to inform about his private expertise with liberating himself from debt slavery, and the way the method was in a position to present him with some long-lost happiness.

This account of how Hamm was profitable in doing this and the constructive modifications it dropped at his life helps readers use his concepts to attain his identical success.

This e book helps to unclutter individuals’s monetary conditions and ends in a extra rewarding life. Going from debt to wealth himself, Hamm is ready to put together the reader for each the anticipated and the surprising complexities of private budgeting in immediately’s financial world.

This e book is stuffed with sensible ideas and instruments that the reader can apply to their very own life. Its skill to be motivating and empowering helps the reader to proactively create more healthy relationships with each cash and other people.

Utilizing private anecdotes, Hamm is ready to interact the reader all through the e book and maintain them targeted. He additionally will get proper to the purpose with out including in plenty of fluff materials, so that you by no means really feel like you’re losing your time studying by issues that aren’t essential.

Whereas plenty of the factors on this e book are already made on his weblog, that is nonetheless an awesome place to place his message collectively to assist readers obtain the monetary success that he has.

2. 365 Methods to Reside Low-cost by Trent Hamm

Takeaways:

- 365 Methods to Reside Low-cost provides a wealth of sensible ideas and techniques for saving cash and dwelling frugally, offering actionable recommendation for people in search of to scale back bills and obtain monetary safety.

- Trent Hamm shares insights on budgeting, good procuring, and resourceful dwelling, presenting a various array of frugal dwelling recommendations appropriate for varied existence and circumstances.

- The e book encourages readers to domesticate a mindset of conscious spending and resourcefulness, selling the worth of creating intentional selections to stretch one’s assets and dwell extra economically.

- 365 Methods to Reside Low-cost serves as a complete information for people seeking to optimize their funds, providing artistic and sustainable approaches to minimizing prices and maximizing worth in day by day life.

- Hamm’s work offers a helpful useful resource for people in search of to reinforce their monetary well-being, providing a large number of sensible and actionable recommendations for dwelling frugally and taking advantage of obtainable assets.

365 Methods to Reside Low-cost: Your On a regular basis Information to Saving Cash is definitely a frugal dwelling e book. But it surely additionally discusses methods to save lots of long-term cash. For instance, utilizing chilly water whereas washing your garments can save virtually $65 a 12 months, whereas investing in a deep freezer and shopping for meals in bulk can save on groceries.

Hamm encourages his readers to check out their very own lives and to appreciate that there are numerous methods to dwell on much less. Providing a large number of the way to chop prices, this e book on saving cash nonetheless makes positive that you’re dwelling a life-style that’s satisfying for you.

Whereas a few of the ideas on this e book have been round for a very long time, this can be a excellent place to brush up on some money-saving methods and see what new issues you possibly can be taught that may enable you save.

This e book does an awesome job in mentioning a few of the useless on a regular basis spending that folks are inclined to do. It helps readers determine the additional bills in their very own lives that may be reduce for the long-term good.

3. Couponing for the Remainder of Us by Kasey Knight Trenum

Takeaways:

- Couponing for the Remainder of Us provides sensible insights and techniques for people eager about saving cash by couponing, offering ideas tailor-made for a variety of existence and schedules.

- Kasey Knight Trenum shares recommendation on leveraging coupons successfully, emphasizing the significance of group, planning, and understanding retailer insurance policies to maximise financial savings.

- The e book encourages readers to undertake a strategic and conscious strategy to couponing, providing steering on discovering, organizing, and utilizing coupons to attain vital reductions on on a regular basis purchases.

- Couponing for the Remainder of Us serves as a helpful useful resource for these in search of to optimize their price range by couponing, providing sensible recommendation and real-world examples to assist readers navigate the world of coupon financial savings.

- Trenum’s work offers actionable methods and insights for people seeking to harness the facility of coupons to scale back bills and benefit from their family price range.

Couponing for the Remainder of Us: The Not-So-Excessive Information to Saving Extra is a superb e book for individuals who like the thought of couponing, however don’t love the thought of spending their time doing it.

Trenum is properly conscious of the truth that individuals don’t need to spend time clipping coupons, but in addition is aware of how a lot cash coupons can save households on this tight economic system.

This e book helps individuals discover coupons for what their household eats, methods to chop down on Web payments, the right way to decide sale cycles, and the right way to make procuring much less irritating.

The creator reveals the reader how straightforward it’s to save cash on on a regular basis issues in order that they’ll have a bit extra monetary freedom.

An empowering and trustworthy learn, Couponing for the Remainder of Us: The Not-So-Excessive Information to Saving Extra can also be humorous, so it’s relatable and simple to learn. With the creator being a spouse and mom, she is ready to deeply join with readers who’re additionally in those self same roles.

Probably the greatest issues about this e book is that it’s not about excessive couponing—it’s about manageable issues that folks can do whereas they’re procuring to assist get monetary savings.

4. Cash Secrets and techniques of the Amish by Lorilee Craker

Test eBook Value | Test Audiobook Value

Takeaways:

- Cash Secrets and techniques of the Amish provides helpful monetary knowledge impressed by the frugal and community-oriented life-style of the Amish, offering insights into easy dwelling, thrift, and monetary stewardship.

- Lorilee Craker shares sensible recommendation on budgeting, saving, and conscious spending, drawing from the timeless ideas of Amish cash administration to supply actionable methods for contemporary readers.

- The e book emphasizes the significance of resourcefulness, contentment, and neighborhood help in attaining monetary safety, highlighting the worth of dwelling inside one’s means and making intentional monetary selections.

- Cash Secrets and techniques of the Amish serves as a supply of inspiration for people in search of to reinforce their monetary well-being, providing a novel perspective on frugality, gratitude, and the pursuit of a extra significant and sustainable relationship with cash.

- Craker’s work offers actionable insights and real-life examples that showcase the enduring knowledge of Amish monetary practices, providing readers a roadmap for attaining better monetary stability and contentment.

What’s it in regards to the Amish that has allowed them to not simply survive however truly thrive throughout occasions of financial turmoil?

Cash Secrets and techniques of the Amish: Discovering True Abundance in Simplicity, Sharing, and Saving will get to the underside of that thriller and presents the reader with many tried and true Amish monetary habits that may be associated to anybody’s monetary actuality.

These habits have been used for generations and might help make money last more and accumulate wealth.

This e book is enjoyable to learn within the sense that the creator offers catchy phrases to dwell by, reminiscent of “use it up, put on it out, make do, or do with out” and “repurpose, recycle, and reuse.” The good money-saving concepts illustrated are sensible even for many who don’t dwell a life as smart because the Amish.

This e book on saving is each touching and humorous whereas offering an eye-opening account of how the Amish make ends meet. The tales discuss buying and selling for items and providers, bargaining, dwelling with much less, staying out of debt, and even stopping the behavior of making an attempt to impress others.

This e book is not a lot about earning money as it’s about self-discipline, household, and redefining what it means to be rich. It encourages the reader to see extra clearly what is actually helpful in life, and helps to encourage individuals to alter their views on life.

That is a simple learn that may assist anybody decrease their consumerism. Whereas there may be not plenty of new recommendation in right here for individuals who already dwell frugally, it offers an awesome look into the lives of a distinct tradition that has been in a position to be financially profitable whereas others haven’t.

5. The Budgeting Behavior by SJ Scott and Rebecca Livermore

Test eBook Value | Test Audiobook Value

Budgeting is the important thing to success in private finance. Should you wouldn’t have a great grasp of your funds by a price range it’s laborious to handle your cash.

The Budgeting Behavior: How one can Make a Finances and Keep on with It! offers step-by-step course of that may enable you grasp budgeting.

Let’s face it. Budgets are boring. This isn’t a flashy matter, like earning money, investing or beginning a facet hustle. It’s drab and boring. Like brushing your enamel.

However what brushing your enamel is to non-public hygiene, budgeting is to finance. It might be boring however doing it proper is the lynchpin on high of which all monetary success rests.

On this e book, we tried to make budgeting as fascinating because it probably could possibly be. However extra importantly, we attempt to present a sensible information to create a easy, however efficient price range. Extra importantly, this e book teaches you the right way to make a behavior out of following your price range, making a price range that rather more efficient.

6. Reduce Your Grocery Invoice in Half With America’s Least expensive Household by Steve Economides and Annette Economides

Test eBook Value | Test Audiobook Value

Takeaways:

- Reduce Your Grocery Invoice in Half With America’s Least expensive Household provides sensible methods and ideas for lowering grocery bills and maximizing financial savings, offering actionable recommendation for budget-conscious consumers.

- Steve and Annette Economides share insights on meal planning, good procuring, and frugal cooking, presenting a complete strategy to economizing on meals prices with out sacrificing high quality or vitamin.

- The e book encourages readers to undertake a strategic and intentional strategy to grocery procuring, providing steering on leveraging gross sales, coupons, and bulk shopping for to attain vital reductions in meals bills.

- Reduce Your Grocery Invoice in Half With America’s Least expensive Household serves as a helpful useful resource for people in search of to optimize their grocery price range, offering sensible recommendation and real-life examples to assist readers benefit from their meals {dollars}.

- The Economides’ work offers actionable methods and insights for people seeking to streamline their grocery spending and benefit from their family price range, providing a roadmap for attaining substantial financial savings on meals bills.

Reduce Your Grocery Invoice in Half With America’s Least expensive Household: Contains So Many Revolutionary Methods You Will not Need to Reduce Coupons is a superb e book for individuals who need to get monetary savings on their on a regular basis groceries with out spending the time that’s wanted to seek for coupons.

The authors provide ideas that may reduce down in your procuring journeys to once-a-week or much less whereas consuming more healthy and saving cash. Written by a husband and spouse who follow what they preach, this can be a relatable e book with plenty of lifelike ideas.

Generally known as “America’s Least expensive Household,” the authors current methods and methods to save cash yearly by slicing down on grocery payments. Probably the greatest issues about this e book is that the information offered are helpful whether or not you reside by your self or have a household of seven.

This frugal dwelling e book is a simple and light-weight learn that evokes individuals to make small modifications that can lead to giant pay-offs. Whereas it might be laborious to imagine {that a} household can reduce their grocery invoice in half, the authors present step-by-step directions to take action.

This page-turner has one thing to be taught in every chapter. The reader doesn’t have to complete the complete e book earlier than starting to save cash. The cash-saving concepts begin instantly, and the e book is straightforward to leap round in if you wish to skip chapters or return to reread one thing.

A number of the ideas on this e book are seemingly repeats for lots of people, however they’re strong items of recommendation which are price revisiting. Not like another books, this one consists of recipes and meal recommendations which are nice for individuals dwelling on a price range.

Probably the greatest frugal dwelling books on the market. This e book has so some ways to save lots of, and offers a ton of actionable recommendation to assist households meet their price range wants.

7. You Are a Badass at Making Cash by Jen Sincero

Test eBook Value | Test Audiobook Value

Takeaways:

- You Are a Badass at Making Cash provides empowering insights and techniques for remodeling one’s mindset and relationship with cash, offering a contemporary perspective on wealth creation and monetary abundance.

- Jen Sincero shares sensible recommendation on overcoming limiting beliefs, embracing threat, and taking daring motion to attain monetary success, drawing from private experiences and anecdotes to encourage readers.

- The e book encourages readers to domesticate a constructive and proactive mindset in the direction of cash, providing steering on harnessing the facility of intention, gratitude, and self-belief within the pursuit of economic prosperity.

- You Are a Badass at Making Cash serves as a motivational and sensible information for people in search of to raise their monetary actuality, providing actionable steps and mindset shifts to unlock their incomes potential.

- Sincero’s work offers a mix of motivational insights and actionable methods, empowering readers to interrupt by self-imposed obstacles and step into their capability for creating wealth and monetary abundance.

Jen Sincero had a blockbuster hit together with her debut e book, You’re a Badass. This e book helped individuals to come back to phrases with the issues that have been holding them again in life and retaining them from reaching their potential.

She does the identical factor with You Are a Badass at Making Cash: Grasp the Mindset of Wealth. Besides she does it for cash.

She helps individuals to know the issues which are holding them again financially. She helps individuals attain their cash making potential, and reveals us the correct mindset to attain monetary success. And he or she does all this with a novel model and sass that made individuals love the primary e book.

8. The Minimalist Finances by Simeon Lindstrom

Takeaways:

- The Minimalist Finances provides sensible steering on simplifying funds and prioritizing spending primarily based on private values, offering a minimalist strategy to attaining monetary freedom and contentment.

- Simeon Lindstrom shares insights on decluttering bills, conscious consumption, and intentional dwelling, presenting a holistic perspective on budgeting that aligns with minimalist ideas.

- The e book encourages readers to reassess their relationship with cash and possessions, providing methods for lowering monetary litter and aligning spending with long-term objectives and success.

- The Minimalist Finances serves as a helpful useful resource for people in search of to streamline their funds, offering actionable recommendation and mindset shifts to domesticate an easier and extra intentional strategy to cash administration.

- Lindstrom’s work offers sensible methods and thought-provoking insights for people seeking to embrace minimalism as a method of attaining monetary readability, lowering stress, and fostering a extra significant and intentional life-style.

I like easy issues. Far too usually books on finance are overly advanced. It’s extra environment friendly to have brief, fast however sensible recommendation. That’s what I really feel this assortment of three budgeting books offers.

Every “e book” is pretty brief, however they’re all fast and simple reads completely overlaying totally different facets of correct budgeting.

Nonetheless, though I preferred them as a result of they’re straightforward to comply with and logical, I might even have preferred extra sensible examples.

In some ways The Minimalist Finances BOXED SET – A Sensible Information On How To Spend Much less and Reside Extra have been as a lot about forming the correct budgeting mindset as they have been in regards to the facets of the right way to truly make a price range.

Of all three “books”, the third part has essentially the most sensible recommendation for the right way to truly make that price range. So stick round till the tip.

9. 31 Days of Dwelling Nicely and Spending Zero by Ruth Soukup

Takeaways:

- 31 Days of Dwelling Nicely and Spending Zero provides a sensible and actionable information to a month-long spending freeze, offering methods for saving cash, decluttering, and reevaluating consumption habits.

- Ruth Soukup shares insights on frugal dwelling, intentional consumption, and inventive methods to repurpose assets, providing a complete strategy to resetting spending patterns and attaining monetary mindfulness.

- The e book encourages readers to embrace a minimalist and resourceful mindset, offering a step-by-step plan to scale back bills, make do with what’s available, and discover contentment in simplicity.

- 31 Days of Dwelling Nicely and Spending Zero serves as a helpful useful resource for people in search of to reset their relationship with cash and possessions, providing actionable steps and sensible ideas for a transformative spending freeze expertise.

- Soukup’s work offers a roadmap for people seeking to recalibrate their spending habits, declutter their lives, and domesticate a extra intentional and conscious strategy to dwelling properly inside their means.

This step-by-step e book could also be useful for you in the event you really feel like your price range has gone off monitor and you’ll’t make it to the tip of the month with out counting your pennies. The creator offers recommendation on the right way to do a month of no spending to reset your spending habits and get you again in your toes.

31 Days of Dwelling Nicely and Spending Zero: Freeze Your Spending. Change Your Life provides a month of day by day challenges for spending much less cash, and, in some instances, no cash.

There are modern tips about the right way to acquire confidence in planning meals, organizing the house, and changing into extra artistic with out spending cash.

With the moment modifications that the creator offers, readers are motivated to dwell a month of zero spending whereas nonetheless discovering pleasure in it. There are new concepts on what to do with previous meals, and even some budget-friendly methods to repurpose issues you have already got.

With anecdotes from individuals who have efficiently accomplished this problem, this e book provides encouragement and inspiration to its readers. It consists of straightforward methods for promoting stuff you personal and slicing down in your grocery invoice.

It helps change the reader’s perspective in regards to the issues that matter essentially the most in life, and that may deliver a brand new degree of pleasure and togetherness to the family.

This e book is probably not for you in the event you dwell alone and are in search of methods to chop prices, however it’s nice for households with homes and kids who need to get monetary savings however do not assume they’ll.

10. Dwelling Nicely, Spending Much less! by Ruth Soukup

Takeaways:

- Dwelling Nicely, Spending Much less! provides sensible recommendation on simplifying life, managing funds, and discovering contentment, offering a holistic strategy to dwelling a extra intentional and fulfilling life.

- Ruth Soukup shares insights on decluttering, budgeting, and prioritizing values, providing a blueprint for attaining a balanced and purposeful life-style whereas managing assets properly.

- The e book encourages readers to reassess their spending habits and embrace simplicity, offering actionable methods for lowering extra, minimizing waste, and aligning spending with private objectives and values.

- Dwelling Nicely, Spending Much less! serves as a helpful useful resource for people in search of to streamline their lives and funds, providing sensible steering and mindset shifts to domesticate a extra intentional and contented way of life.

- Soukup’s work offers a mix of actionable methods and inspirational insights, empowering readers to make conscious selections, declutter their lives, and pursue a path to dwelling properly inside their means.

Dwelling Nicely, Spending Much less!: 12 Secrets and techniques of the Good Life is all about discovering steadiness in a chaotic life and price range. Ruth Soukup is aware of firsthand how irritating an unorganized life and price range might be.

By her account, the creator tells private tales and offers sensible motion plans to encourage the reader to make lasting modifications to non-public funds and objectives.

This can be an awesome financial savings e book for you in case you are in search of encouragement throughout an awesome or irritating time making an attempt to satisfy tight price range necessities. It’s aimed in the direction of moms who’re making an attempt to juggle life’s calls for with society’s stress to maintain up with everybody else.

It’s a sensible and relatable information for girls who need to get their lives organized however do not know the place to begin. It offers an inspiring and sensible lesson on the right way to spend cash properly with out compromising an awesome life.

Whereas this e book does have a largely autobiographic really feel to it, some might discover this beneficial as a result of the creator’s private tales relate to her general message.

11. The Yr With no Buy by Scott Dannemiller

Takeaways:

- The Yr With no Buy chronicles the creator’s transformative journey of dwelling a minimalist life-style by abstaining from non-essential purchases for a whole 12 months, providing profound insights into consumerism, contentment, and intentional dwelling.

- Scott Dannemiller shares reflections on simplifying life, reevaluating priorities, and discovering success past materials possessions, offering a compelling narrative that challenges standard notions of consumption and happiness.

- The e book encourages readers to rethink their relationship with materialism and consumption, providing a thought-provoking exploration of the affect of conscious spending and the pursuit of a extra purposeful and contented existence.

- The Yr With no Buy serves as a supply of inspiration for people in search of to interrupt free from the cycle of consumerism, providing a compelling narrative and actionable insights on embracing simplicity and discovering pleasure past materials accumulation.

- Dannemiller’s work offers a heartfelt and introspective account of the transformative energy of intentional dwelling, inspiring readers to reassess their priorities, declutter their lives, and pursue a path to better success and contentment.

The Yr With no Buy: One Household’s Quest to Cease Purchasing and Begin Connecting on saving cash is an account of 1 household’s quest to alter their outlook on life by stopping procuring and beginning to join with one another.

It was written by a former missionary who served in Guatemala, and whose household discovered itself deep in a lifetime of consumption with a endless cycle of wanting extra however by no means being happy. The household made the drastic change of deciding to not buy any nonessential objects for a complete 12 months.

Readers might start this e book doubting that they may go a whole 12 months with out shopping for garments or books, however by the humorous wit and poignant conclusions from the creator, this e book helps readers see their spending in a brand new mild.

Stuffed with fascinating analysis, the e book seems to be at fashionable America’s spending habits, together with the authors’ personal expertise of highs and lows whereas dropping out of the patron tradition.

The e book does an awesome job of unveiling what is really essential in life—which has nothing to do with gift-giving or maintaining with the neighbors. The household discovers and shares truths about human nature and what the key is to discovering pleasure.

This can be a helpful e book for anybody who has ever wished to scale back the stress of their life by focusing much less on materials objects and dwelling extra.

12. The One Week Finances by “The Budgetnista” Tiffany Aliche

Test eBook Value | Test Audiobook Value

Takeaways:

- The One Week Finances provides a sensible and accessible information to monetary planning, offering a step-by-step strategy to creating and implementing a price range inside every week.

- Tiffany Aliche, often called “The Budgetnista,” shares insights on budgeting, saving, and debt administration, providing actionable methods and instruments to empower readers to take management of their funds.

- The e book encourages readers to undertake a proactive and arranged strategy to cash administration, offering steering on setting monetary objectives, monitoring bills, and constructing a sustainable budgeting system.

- The One Week Finances serves as a helpful useful resource for people in search of to enhance their monetary literacy and obtain better monetary stability, providing sensible recommendation and real-world examples to assist readers navigate the method of budgeting.

- Aliche’s work offers an accessible and empowering roadmap for people seeking to acquire management over their funds, providing a complete plan to create and implement a personalised price range in a brief timeframe.

The One Week Finances: Study to Create Your Cash Administration System in 7 Days or Much less! is a workbook for anybody who desires to handle their on a regular basis cash with out the effort of determining how it’s best spent. A enjoyable and empowering learn, it reveals readers the right way to make frugal selections whereas nonetheless dwelling a superb life by doing extra with much less.

This e book helps to debunk some widespread misconceptions about issues, reminiscent of consolidating bank cards and paying off debt. It presents a transparent and easy system for slicing bills and maximizing financial savings to satisfy monetary objectives.

The strategies used on this budgeting e book are for individuals of any age, however the e book is geared extra in the direction of younger adults who’re climbing out of debt making an attempt to get on their toes.

13. How one can Cease Dwelling Paycheck to Paycheck (2nd Version) by Avery Breyer

Takeaways:

- How one can Cease Dwelling Paycheck to Paycheck provides sensible methods for breaking the cycle of economic shortage and attaining better stability, offering actionable steps to construct financial savings, cut back debt, and create a safer monetary future.

- Avery Breyer shares insights on budgeting, saving, and investing, providing a complete strategy to managing cash and gaining management over one’s monetary scenario.

- The e book encourages readers to undertake a proactive and disciplined strategy to cash administration, offering steering on constructing emergency funds, growing revenue, and making knowledgeable monetary selections.

- How one can Cease Dwelling Paycheck to Paycheck serves as a helpful useful resource for people in search of to reinforce their monetary well-being, providing sensible recommendation and real-life examples to assist readers navigate the trail to monetary safety.

- Breyer’s work offers actionable methods and empowering insights for people seeking to break away from the paycheck-to-paycheck cycle, providing a roadmap for attaining better monetary freedom and peace of thoughts.

This timeless bestseller provides the motivation and data that’s wanted in an effort to construct up a safety web of emergency money, get out of debt, and keep away from the 11 commonest however worst price range traps.

Breyer provides her readers a few of the most essential issues that have to be performed to take management of funds and repay debt. Not like a few of the different books on saving cash that you simply discover on this submit.

Avery’s saving moneyThis e book teaches an entire price range system that’s even applicable for younger adults who’re simply getting began—and the strategies solely take quarter-hour every week to keep up.

This easy budget-planning software helps rework funds to remove monetary stress. To enhance upon the primary bestselling e book, this version provides a chapter on cash and happiness, which is without doubt one of the most essential components relating to useless spending.

How one can Cease Dwelling Paycheck to Paycheck (2nd Version): A confirmed path to cash mastery in solely quarter-hour every week! (Good Cash Blueprint) is perhaps the most effective budgeting and financial savings books for you in the event you discover that your feelings are sometimes tied to your checking account and you’ve got began to lose management of your funds.

14. How one can Handle Your Cash When You Do not Have Any (Second Version) by Erik Wecks

Test eBook Value | Test Audiobook Value

Takeaways:

- How one can Handle Your Cash When You Do not Have Any provides sensible and empathetic recommendation for people going through monetary hardship, offering actionable methods and instruments for taking advantage of restricted assets.

- Erik Wecks shares insights on budgeting, frugal dwelling, and resourcefulness, providing a compassionate and lifelike strategy to managing cash throughout difficult circumstances.

- The e book encourages readers to undertake a proactive and resilient mindset in the direction of monetary administration, offering steering on prioritizing wants, discovering artistic options, and constructing a basis for future monetary stability.

- How one can Handle Your Cash When You Do not Have Any serves as a helpful useful resource for people in search of to navigate monetary adversity, providing sensible recommendation and real-world examples to assist readers make knowledgeable and empowering monetary selections.

- Wecks’ work offers actionable methods and compassionate insights for people seeking to handle their funds successfully regardless of restricted means, providing a roadmap for attaining better monetary resilience and hope for the longer term.

Not like different cash books, How one can Handle Your Cash When You Do not Have Any (Second Version) is written particularly for individuals who battle every month paying their payments.

It talks the reader by a no-nonsense have a look at the realities of immediately’s economic system and offers a simple path to comply with towards monetary stability.

Additionally, not like different monetary authors, Wecks hasn’t struck it wealthy. He is ready to provide a first-hand account of dwelling on the cash you could have throughout tough occasions. As a substitute of educating individuals the right way to create wealth, this e book urges readers to do the most effective they’ll with the revenue they have already got, regardless of its measurement.

With jargon-free writing, this e book saving and budgeting is straightforward for anybody to choose up, it doesn’t matter what the monetary background. It’s opinionated, which can not resonate with all readers, but it surely additionally has its moments of humor.

This can be a fast learn that’s related to readers, because it is stuffed with present, on a regular basis references. This is a perfect e book for the common reader who’s simply making an attempt to make ends meet.

15. Dwelling a Stunning Life on Much less by Danielle Wagasky

Takeaways:

- Dwelling a Stunning Life on Much less provides sensible steering on simplifying life, managing funds, and discovering contentment, offering a holistic strategy to dwelling a extra intentional and fulfilling life.

- Danielle Wagasky shares insights on frugal dwelling, intentional consumption, and inventive methods to repurpose assets, providing a complete perspective on minimalist and purposeful dwelling.

- The e book encourages readers to reassess their spending habits and embrace simplicity, offering actionable methods for lowering extra, minimizing waste, and aligning spending with private objectives and values.

- Dwelling a Stunning Life on Much less serves as a helpful useful resource for people in search of to streamline their lives and funds, providing sensible steering and mindset shifts to domesticate a extra intentional and contented way of life.

- Wagasky’s work offers a mix of actionable methods and inspirational insights, empowering readers to make conscious selections, declutter their lives, and pursue a path to dwelling properly inside their means.

Written by somebody with first-hand expertise, Dwelling a Stunning Life on Much less: The Blissful and Home Information to Meals, Enjoyable, and Funds reveals individuals the right way to dwell fortunately on a really small amount of cash.

It consists of lifelike ideas and real-life examples to assist the reader relate to what the creator has been by, and be taught from her experiences.

This e book on budgeting is straightforward to learn, as it’s written in an informal and conversational tone. It’s a humorous e book whereas additionally being encouraging for anybody who wants assist navigating their funds and sustaining their price range.

This e book is clearly geared extra in the direction of ladies and moms who’re managing the budgets for his or her households. It may well present hope to lots of people who’re simply beginning out on their monetary journey.

16. The All the pieces Budgeting E book by Tere Stouffer

Takeaways:

- The All the pieces Budgeting E book provides a complete information to budgeting, offering sensible methods and instruments for creating and sustaining a personalised price range that aligns with particular person monetary objectives.

- Tere Stouffer shares insights on cash administration, saving, and lowering debt, providing a step-by-step strategy to budgeting that empowers readers to take management of their funds.

- The e book encourages readers to undertake a proactive and arranged strategy to monetary planning, offering steering on monitoring bills, setting priorities, and making knowledgeable spending selections.

- The All the pieces Budgeting E book serves as a helpful useful resource for people in search of to enhance their monetary literacy and obtain better monetary stability, providing sensible recommendation and real-world examples to assist readers navigate the method of budgeting.

- Stouffer’s work offers an accessible and empowering roadmap for people seeking to acquire management over their funds, providing a complete plan to create and preserve a price range that helps long-term monetary well-being.

The All the pieces Budgeting E book: Sensible Recommendation For Saving And Managing Your Cash – From Day by day Budgets To Lengthy-Time period Objectives offers plenty of sensible budgeting do’s and don’ts. It does dwell as much as its promise of overlaying all the pieces about budgeting from cradle to grave.

Nonetheless, the e book was written over 5 years in the past and the age has begun to indicate just a little bit. There may be nonetheless a ton of excellent information right here, just a few that’s dated. If you realize little about budgeting this could possibly be an awesome e book for you.

This e book offers step-by-step directions on the right way to deal with crucial facets of private finance. Corresponding to: How one can spend much less cash. Methods to lower your widespread bills.

How one can maintain you funds so as. The significance of planning for the surprising. Setting monetary objectives. And naturally making a price range.

17. The Latte Issue by David Bach and John David Mann

Test eBook Value | Test Audiobook Value

Takeaways:

- The Latte Issue emphasizes the facility of small day by day selections in attaining monetary freedom, providing a compelling narrative that explores the affect of incremental modifications on long-term wealth-building.

- David Bach and John David Mann share insights on budgeting, saving, and investing, presenting a relatable and actionable strategy to monetary administration that resonates with readers at any revenue degree.

- The e book encourages readers to reassess their spending habits and embrace the idea of paying oneself first, offering steering on prioritizing monetary objectives and making intentional selections to construct wealth over time.

- The Latte Issue serves as a helpful useful resource for people in search of to rework their relationship with cash, providing sensible recommendation and mindset shifts to domesticate a extra intentional and affluent monetary future.

- Bach and Mann’s work offers a mix of relatable anecdotes and actionable methods, empowering readers to make knowledgeable monetary selections and harness the potential of small modifications to create a safer and fulfilling monetary life.

In The Latte Issue: Why You Do not Need to Be Wealthy to Reside Wealthy, Bach and his co-author cowl the three secrets and techniques to monetary freedom.

They do that by telling a parable of a younger barista struggling to make ends meet as she is drowning in a sea of debt. Because the story evolves she discovers the secrets and techniques of wealth and learns the few modifications she will be able to make to safe her monetary future and dwell a greater life.

I like books like this that mix leisure and sensible data into an pleasing e book. Based mostly on Bach’s different books I’m positive that this can be an entertaining and academic e book. Discover out extra within the hyperlink(s) under.

18. Your Cash or Your Life by Vicki Robin and Joe Dominguez

Test eBook Value | Test Audiobook Value

Takeaways:

- Your Cash or Your Life: 9 Steps to Remodeling Your Relationship with Cash and Attaining Monetary Independence (Absolutely Revised and Up to date) presents a transformative strategy to non-public finance, providing a complete information to attaining monetary independence and redefining the connection with cash.

- Vicki Robin and Joe Dominguez share insights on frugality, conscious consumption, and the idea of “sufficient,” offering a roadmap for aligning spending with private values and long-term success.

- The e book encourages readers to reassess their monetary priorities and embrace the idea of time as a helpful useful resource, providing actionable steps to attain better monetary autonomy and a extra significant life.

- Your Cash or Your Life serves as a helpful useful resource for people in search of to realize management over their funds, providing sensible recommendation and mindset shifts to domesticate a extra intentional and purposeful strategy to cash administration.

- Robin and Dominguez’s work offers a mix of thought-provoking philosophy and actionable methods, empowering readers to make acutely aware selections, obtain monetary independence, and dwell a extra fulfilling and sustainable life.

19. Broke Millennial by Erin Lowry

Test eBook Value | Test Audiobook Value

Takeaways:

- Broke Millennial: Cease Scraping By and Get Your Monetary Life Collectively provides sensible monetary recommendation tailor-made to the millennial era, offering actionable methods for budgeting, saving, and investing in a relatable and accessible method.

- Erin Lowry shares insights on managing debt, navigating monetary independence, and constructing a powerful monetary basis, providing a complete information to empower younger adults to take management of their cash.

- The e book encourages readers to confront monetary challenges head-on, offering steering on speaking about cash, setting lifelike objectives, and making knowledgeable monetary selections.

- Broke Millennial serves as a helpful useful resource for younger adults in search of to reinforce their monetary literacy and obtain better monetary stability, providing relatable recommendation and real-world examples to assist readers navigate the complexities of private finance.

- Lowry’s work offers a mix of sensible methods and empathetic insights, empowering readers to beat monetary obstacles, construct confidence, and lay the groundwork for a safe monetary future.

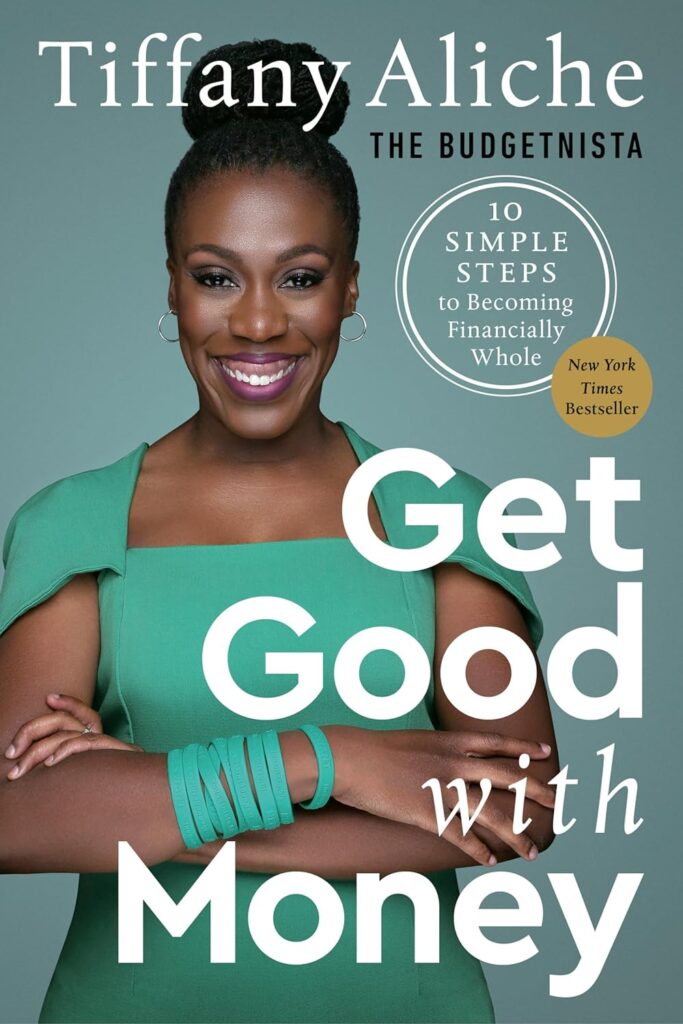

20. Get Good with Cash by “The Budgetnista” Tiffany Aliche

Test eBook Value | Test Audiobook Value

Takeaways:

- Get Good with Cash: Ten Easy Steps to Changing into Financially offers sensible and empowering monetary recommendation, providing actionable methods for budgeting, saving, and constructing wealth in a relatable and accessible method.

- Tiffany Aliche, often called “The Budgetnista,” shares insights on overcoming monetary obstacles, cultivating a constructive cash mindset, and attaining monetary wellness, offering a complete information to empower readers to take management of their funds.

- The e book encourages readers to confront their monetary fears and misconceptions, providing steering on setting achievable monetary objectives, managing debt, and making a sustainable monetary plan.

- Get Good with Cash serves as a helpful useful resource for people in search of to reinforce their monetary literacy and obtain better monetary stability, providing sensible recommendation and real-world examples to assist readers navigate the complexities of private finance.

- Aliche’s work offers a mix of sensible methods and motivational insights, empowering readers to rework their relationship with cash, construct long-term wealth, and attain monetary freedom.

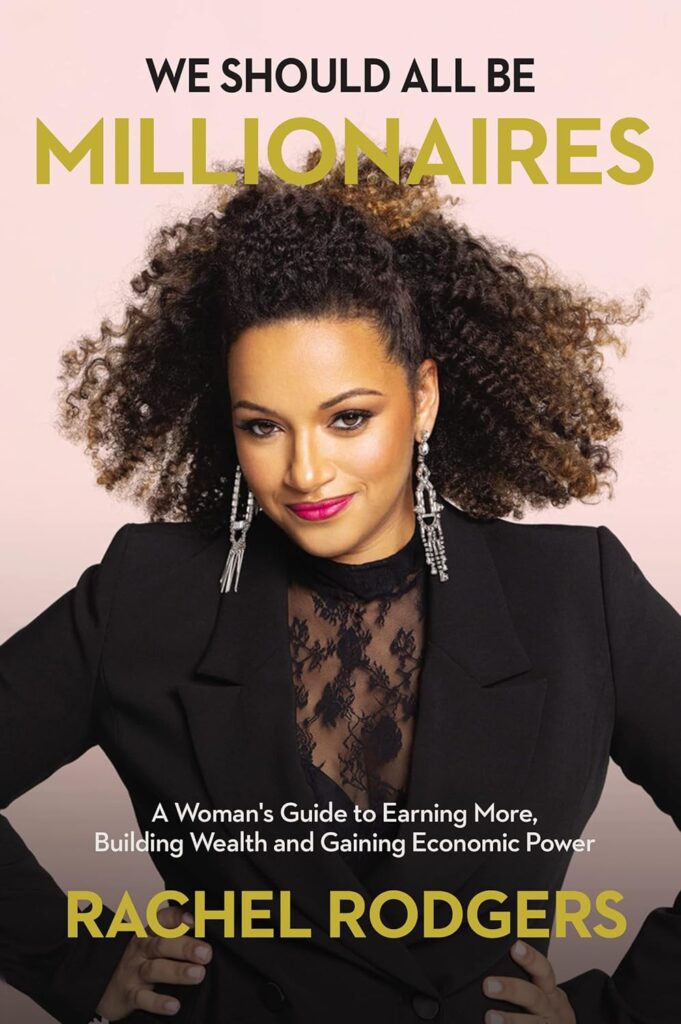

21. We Ought to All Be Millionaires by Rachel Rodgers

Test eBook Value | Test Audiobook Value

Takeaways:

- We Ought to All Be Millionaires: A Lady’s Information to Incomes Extra, Constructing Wealth, and Gaining Financial Energy challenges conventional monetary narratives and provides a contemporary perspective on wealth-building, significantly for girls and marginalized communities, emphasizing the significance of economic empowerment and abundance.

- Rachel Rodgers shares insights on entrepreneurship, wealth creation, and overcoming societal obstacles, offering a roadmap for people to redefine their relationship with cash and obtain monetary success on their very own phrases.

- The e book encourages readers to embrace their price and worth, providing steering on wealth mindset, strategic incomes, and leveraging assets to create a lifetime of abundance and affect.

- We Ought to All Be Millionaires serves as a name to motion for people to step into their monetary energy, providing sensible recommendation and actionable steps to interrupt by limiting beliefs and construct sustainable wealth.

- Rodgers’ work offers a mix of motivational steering and actionable methods, empowering readers to problem the established order, construct wealth, and create a extra equitable and affluent future for themselves and their communities.

Ultimate Ideas on Books on Budgeting

I hope you loved this listing of the 21 greatest books on budgeting, saving cash, frugal dwelling. Hopefully, these books will enable you cease dwelling paycheck to paycheck and enable you climb out of debt.

I see these books as a sensible means that can assist you heed the recommendation from most of the greatest monetary books for learners. You might even discover one in every of these books to be full sufficient that it’s the solely budgeting e book you may ever want.

Should you loved this listing, why not try some extra nice associated lists of nice books. We have now the primary “web page” of OVER 250 self assist/private improvement books. This predominant web page has hyperlinks to many smaller e book lists (identical to this one)

If you’re usually investing, it’s possible you’ll have an interest within the greatest investing books of all time. This can be a assortment 16 books “must-read” books, funding books that ought to, frankly, be required studying for any aspiring investor earlier than they make any strikes with investing their very own cash.

If you’re struggling to satisfy your everyday dwelling bills. Actual property funding might appear to be a dream out of your far, far future. But it surely is probably not so far as you assume.

A number of the 16 books under let you know the right way to begin creating an revenue from actual property funding with little upfront cash of your personal. Books on budgeting, financial savings and getting debt free must be first, however actual property funding books could also be subsequent on you listing.

And in the event you’re in search of extra assets on books to learn, make sure you try these weblog posts:

[ad_2]