[ad_1]

Affect on EUR/USD and EUR/GBP Amid Financial Coverage Divergence

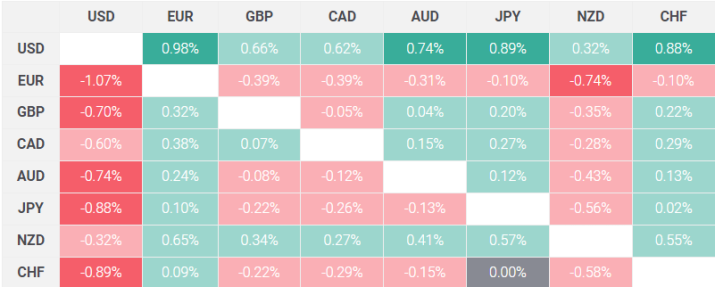

The euro fell towards main currencies, together with the US greenback and the British pound, after the European Central Financial institution (ECB) determined to maintain rates of interest unchanged at their April assembly.

EUR/USD misplaced 0.2%, closing at 1.0725, whereas EUR/GBP fell 0.3%, falling via its 50-day easy transferring common to finish at 0.8542.

ECB’s Dovish Stance Indicators Potential Charge Cuts

Through the press convention, ECB President Christine Lagarde emphasised the financial institution’s shift to a extra dovish financial coverage, implying a price lower as early as June. This transfer is because of higher confidence within the ongoing disinflation course of and a worse financial outlook.

Lagarde acknowledged that the restoration can be underpinned by a gradual enchancment in actual incomes and an enhance in exports, nonetheless, she famous that development dangers stay on the draw back.

Comparative Central Financial institution Insurance policies

The ECB’s projected easing comes forward of comparable steps by the Federal Reserve and the Financial institution of England, which is able to affect the euro’s efficiency towards these currencies.

The Fed’s possibilities of slicing charges have decreased because of current sturdy inflation and labor market knowledge, in distinction to the ECB’s upcoming easing measures.

In distinction, the Financial institution of England could start decreasing borrowing prices by August, however at a slower tempo than the ECB’s predicted 75 foundation factors of easing.

Technical Evaluation: EUR/USD and EUR/GBP

EUR/USD Outlook

Following a sturdy loss, technical indicators point out that if the euro’s depreciation continues, the following help ranges to look at are round February’s lows of 1.0695, with extra draw back potential to 1.0640 and 1.0450.

Nonetheless, a reversal may trigger the EUR/USD to hunt the 50-day and 200-day easy transferring averages at about 1.0825, with a attainable extension to 1.08.65.

EUR/GBP Outlook

EUR/GBP faces related difficulties, having these days retreated from trendline resistance at 0.8585. If the euro falls additional, help could develop at 0.8285, with a substantial hazard of dropping to yr lows.

On the upside, a restoration would face resistance close to the 50-day easy transferring common at 0.8550, and breaking via a longer-term descending trendline at 0.8575 may suggest a bigger rebound.

Market Response and Ultimate Ideas

The market’s response to the ECB’s information was gentle, with the euro displaying modest bearish traits shortly after the choice.

The ECB’s sustained dovish stance signifies that, whereas foreign money devaluation has instant penalties, the longer-term focus is on managing inflation and supporting financial restoration contained in the eurozone.

Lastly, merchants can count on extra volatility in EUR/USD and EUR/GBP pairs because the ECB begins to implement price decreases.

The financial coverage divergence between the ECB, Fed, and BoE is anticipated to have a important impression on the buying and selling dynamics of those currencies within the coming months.

Conserving a watch on impending financial knowledge releases and central financial institution statements shall be essential for efficiently navigating these markets.

[ad_2]