[ad_1]

On the earth of buying and selling, embracing a contrarian method can reveal distinct alternatives, significantly throughout instances of intense market sentiment.

This evaluation delves into the current sentiment surrounding the Japanese Yen, using IG shopper sentiment information to offer a nuanced perspective for merchants.

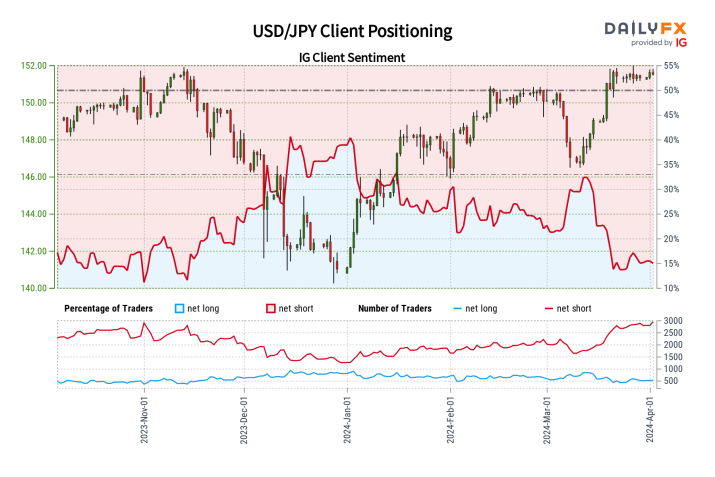

USD/JPY Market Sentiment

In line with IG information, the sentiment in the direction of USD/JPY is principally bearish, as the vast majority of merchants, 84.14% to be exact, maintain net-short positions.

Given the prevailing pessimism and the latest surge in brief positions, plainly there could also be a extra optimistic perspective for USD/JPY, hinting at potential good points.

It’s necessary, although, to mix these indicators with technical and basic analyses for well-informed buying and selling choices.

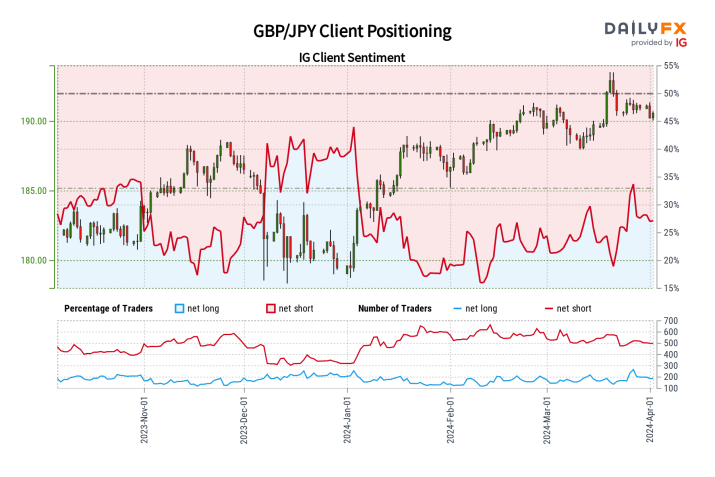

GBP/JPY Market Sentiment

In an analogous vein, the GBP/JPY pair is at present experiencing a notable bearish sentiment, as a majority of merchants, particularly 72.7%, are positioned on the net-short facet.

The rising negativity and a decline in net-long positions spotlight an optimistic contrarian prediction. It seems that there could also be a potential for a rally in GBP/JPY, which may immediate merchants to keep in mind contrarian indicators inside a wider analytical context.

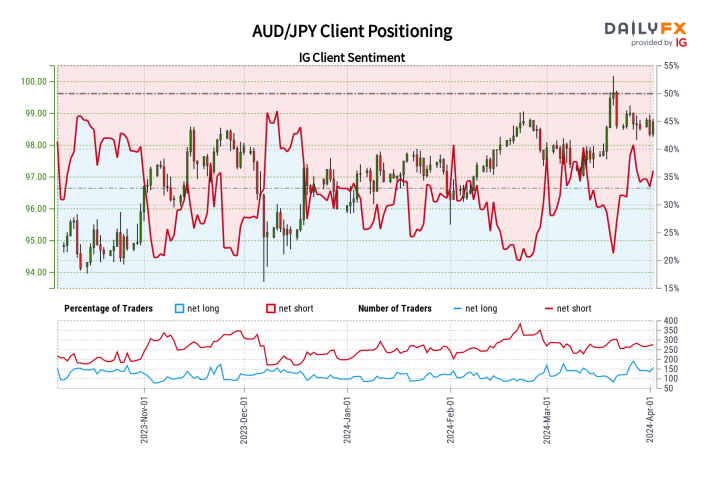

AUD/JPY Market Sentiment

The sentiment for AUD/JPY is according to the total Yen pattern, with 65.19% of merchants being net-short. With the bearish sentiment on the rise and a decline in net-long positions, there’s a constructive contrarian outlook for AUD/JPY, suggesting the opportunity of an upward motion.

Market Outlook and Volatility Warnings

Japan’s Finance Minister Shunichi Suzuki has as soon as once more emphasised the significance of avoiding extreme Yen volatility and has expressed preparedness to take mandatory measures to stabilize the foreign money.

Just like a quantitative analyst, Tokyo is taking a cautious stance in opposition to destabilizing Yen declines, regardless of the absence of fast “decisive motion” threats. The continual point out of intervention indicators their vigilance.

Regardless of the Financial institution of Japan’s latest shift away from destructive rates of interest and their use of dovish language, the Yen’s downtrend stays unchanged.

Market expectations of a extended rate of interest distinction between the U.S. and Japan, supported by remarks from US Federal Reserve Chair Jerome Powell, proceed to exert strain on the Yen.

Given the present USD/JPY pair’s proximity to a 34-year excessive, merchants are carefully monitoring the scenario for any indicators of Tokyo intervention.

Conclusion

When analyzing the Japanese Yen’s future, merchants ought to take into account taking a contrarian method to identify potential reversals or rallies in periods of utmost sentiment.

The present market sentiment in the direction of USD/JPY, GBP/JPY, and AUD/JPY is bearish. This contrasts with official warnings in opposition to extreme volatility, creating a fancy backdrop.

To successfully capitalize on the Yen’s dynamics, merchants might want to make use of a complete buying and selling technique that mixes sentiment evaluation, technical patterns, and basic insights.

[ad_2]